How Much Does It Cost To Develop An Automated Trading System?

Content

For a fee, the automated trading system can scan for, execute and monitor trades, with all orders residing on the server. Traders and investors can turn precise entry, exit, and money management rules into automated trading systems that allow computers to execute and monitor the trades. One of the biggest attractions of strategy automation is that it can take some of the emotion out of trading since trades are automatically placed once certain criteria are met.

The system allows the administrator to set up trading strategies with different market instruments and test them with data from different financial markets and time frames. Building an automated trading system starts with implementing trading strategies. There is no one-size-fits-all approach, so users need to find their preferred strategies that can then be traded automatically. To do this, they have to be able to choose between different technical indicators and use them as a set of rules for trading. Setting up these indicators and implementing trading strategies is a meticulous process that takes more than 150 person-hours. An investment company specializing in active stock trading commissioned us to develop a stock trading bot.

When it comes to getting in or out of a trade, even milliseconds can affect the deal. Therefore, when designing the system, it’s crucial to achieve the lowest possible latency. This is particularly relevant for volatile markets when prices can change too quickly. High-frequency trading systems generate orders immediately when the trading criteria are met, maximizing the chances of getting the best possible deal. The longer the period that you test, the more accurate your data will be, since it will compensate for the limited insights provided by shorter, period-specific market conditions. By observing its behavior through both bearish and bullish markets, you get a fuller picture of your strategy’s effectiveness.

Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy. Know what you're getting into and make sure you understand the ins and outs of the system.

Chapter 2: Backtesting And Validating Strategies

Remember, you should have some trading experience and knowledge before you decide to use automated trading systems. One of the biggest challenges in trading is to plan the trade and trade the plan. Even if a trading plan has the potential to be profitable, traders who ignore the rules are altering any expectancy the system would have had. But losses can be psychologically traumatizing, so a trader who has two or three losing trades in a row might decide to skip the next trade. If this next trade would have been a winner, the trader has already destroyed any expectancy the system had. Automated trading systems allow traders to achieve consistency by trading the plan.

8 "Best" AI Crypto Trading Bots (October 2022) - Unite.AI

8 "Best" AI Crypto Trading Bots (October .

Posted: Wed, 21 Sep 2022 23:32:32 GMT [source]

In fast-moving markets, this instantaneous order entry can mean the difference between a small loss and a catastrophic loss in the event the trade moves against the trader. For traders, one of the biggest challenges is to strictly stick to the developed trading plan. Even a potentially profitable strategy will fail if traders bend their own rules. Automated trading systems allow users to achieve consistency by trading according to a plan. Neither the fear of taking a loss nor the desire to make more profit from trading would lead to a breach of discipline.

Creating Trading Signals

The computer cannot make guesses and it has to be told exactly what to do. Traders can take these precise sets of rules and test them on historical data before risking money in live trading. Careful backtesting allows traders to evaluate and fine-tune a trading idea, and to determine the system's expectancy – i.e., the average amount a trader can expect to win per unit of risk. Before we get into the development of automated trading systems, let’s define the term. ATS is also referred to as algorithmic trading, algo, mechanical or automated trading.

Where a human runs the risk of error due to stress, distraction, rush, or fatigue, the computer acts unmistakably. This is a huge advantage in an activity where a single misclick can literally cost you a fortune. A good starting point is actually checking coinmarketcap.com because it gives users info about volume, market cap and many other important information.

The second data set (sometimes referred to as the “test set”), then, is used to evaluate forecasting performance. And cross-validation provides a way to test the performance of a trading strategy by resembling real-life trading as much as possible by carrying out testing on new data. In the following chapters, we’ll cover in detail all the steps and best practices when developing a consistent, standardized approach to algorithmic trading. Traders do have the option to run their automated trading systems through a server-based trading platform. These platforms frequently offer commercial strategies for sale so traders can design their own systems or the ability to host existing systems on the server-based platform.

Automated Stock Trading Platform

A further distinction can be made between nominal returns (i.e. the net profit or loss expressed in nominal terms) and real returns (i.e. adjustments are made to account for external factors such as inflation). If we use a car racing analogy, then think of backtesting as practice laps on the racetrack, allowing the driver to test the car’s setup parameters and adjust them ex post facto in preparation for race day. Finally, you need to figure out how much you’re going to trade in order to complete your strategy. When we speak of position sizing, what we’re referring to is the size of your position for individual trades, which will depend on variables such as the size of your account, goals, and tolerance for risk. Position sizing revolves around the issue of capital allocation and there are various techniques that traders use (e.g. fixed dollar amount, equal percentage, risk based position sizing, etc.). A trading platform is software with which investors and traders can open, close, and manage market positions through a financial intermediary.

For this client, we developed a cloud-based app that connects to a user’s brokerage account via an API. The bot automates stock trading by executing trades based on preset rules. The bot tracks stocks throughout the day, looking for clues about when to buy, and executes the trade once the preset buy parameters are met. Conversely, the bot executes a sell order once all sell parameters are met. Let’s say that you have an idea and you want to test it based on historical data. The actual historical data that you use to test and optimize your idea is referred to as the “in-sample data” (you might also see this data referred to as “training data”).

Automated trading systems permit the user to trade multiple accounts or various strategies at one time. This has the potential to spread risk over various instruments while creating a hedge against losing positions. What would be incredibly challenging for a human to accomplish is efficiently executed by a computer in milliseconds. The computer is able to scan for trading opportunities across a range of markets, generate orders and monitor trades. Since computers respond immediately to changing market conditions, automated systems are able to generate orders as soon as trade criteria are met.

- Trading using short time frames (“scalping”) attempts to profit from small price changes during short time intervals, but requires strict adherence to a predefined exit strategy in order to avoid significant losses.

- Conversely, the bot executes a sell order once all sell parameters are met.

- There may be a single or miltiple data providers, for example, as backup data sources or for other reasons.

- One of the biggest attractions of strategy automation is that it can take some of the emotion out of trading since trades are automatically placed once certain criteria are met.

- Since computers respond immediately to changing market conditions, automated systems are able to generate orders as soon as trade criteria are met.

- A good rule of thumb for splitting in-sample and out-of-sample data is to use 2/3s of the data set for strategy optimization and the remaining data for out-of-sample validation.

Below we’ll cover best practices, out-of-sample testing, and which metrics to look at. The offers that appear in this table are from partnerships from which Investopedia receives compensation. The word "automation" may seem like it makes the task simpler, but there are definitely a few things you will need to keep in mind before you start using these systems.

How Much Does It Cost To Develop An Automated Trading System?

Automated trading systems typically require the use of software linked to a direct access broker, and any specific rules must be written in that platform's proprietary language. The TradeStation platform, for example, uses the EasyLanguage programming language. The figure below shows an example of an automated https://xcritical.com/ strategy that triggered three trades during a trading session. Even though the term ATS implies automation, it does not exclude manual control, because sometimes users need to fine-tune some parameters. With the trade management functionality, users can manage the trade the moment it is executed.

The other half is ongoing support and maintenance of the existing system. Before signing a contract, find out if the vendor offers further maintenance and on what terms. We provide full-time and part-time developers and dedicated development teams on demand. However, diversity isn’t merely a matter of holding a number of different cryptocurrencies. If you have 10 or 15 different coins, but all produce the same signals, then diversity is a moot point since you’d be better off simply trading one coin. What we’re after are individual signals with a low correlation, so that we achieve diversified returns and a smoother equity curve.

Where To Start To Build An Automated Trading System?

Once everything looks good, then you use the out-of-sample data to validate your results, confirming that you didn’t produce an overfitted strategy that will perform poorly once deployed in live trading. Since it creates a division of data into different sets, cross-validation is used to avoid overfitting. One set will be used to create your model, while the other set will be used to validate the model's accuracy. Trading using short time frames (“scalping”) attempts to profit from small price changes during short time intervals, but requires strict adherence to a predefined exit strategy in order to avoid significant losses. Swing trading means that you hold an asset for a few days to several weeks in order to take advantage of short- to medium-term gains (i.e. profiting according to swings). And position trading, then, is staking a position for a longer period of time, usually for a period of weeks to months.

Whichever digital assets you ultimately choose, your universe should contain more than one star. Simply put, diversification is a risk management strategy that combines a wide array of assets in order to limit your exposure as a trader to any single asset or risk. Given their inherent volatility, crypto markets pose certain challenges that can be mitigated or offset by a diversified portfolio.

All these terms stand for a trading platform that uses computer algorithms to monitor the stock markets for certain conditions. Traders set certain rules for buy and sell orders that are executed automatically via ATS. Another ATS development project was implemented by the Itexus team for an investment management company that provides services to both individual and institutional investors. The algorithmic trading system development is based on a complex, multi-level analysis of prices and the behavior of their derived characteristics.

This is possible by integrating brokers into the automated trading system. Depending on the number of brokerage platforms to be integrated, this can take between 60 and 150 person-hours. The entire point of this exercise is to develop a profitable strategy, but the simple fact is that you will lose on some trades. Once you do, fear of failure dissipates and you can get on with the business of profitable trading. Once your bot has been deployed for live trading, it is very important to monitor it regularly to ensure that it runs as smoothly as it did in backtesting.

Backtesting isn’t merely a one-off procedure, but something that you’ll do again and again before you forward test as well as when you’re live trading. When backtesting, you’ll also need automated stock trading bots to identify in advance key metrics, indicators and results before your actual test . Overall, manual backtesting can be extremely complicated, time-consuming, and even frustrating.

Stock Trading Bot

The other half is providing real-time and historical market data for live sessions and charting. There may be a single or miltiple data providers, for example, as backup data sources or for other reasons. Implementing the feature that would enable the collection and supply of comprehensive market data requires between 60 and 120 person-hours. In fact, let’s say that you’ve created and tested your own algorithmic trading bot.

Chapter 3: Live Trading

However, with over 4,000 cryptocurrencies to choose from, it’s not necessarily an easy decision. The costs shown in the right column are based on the average hourly rate of developers, which is $50 per hour for fintech projects of this complexity. Automated trading software reduces the risk of manual errors and mitigates the human factor.

Entry points are easy; the real difficulty lies in knowing when to exit. Maybe it’s X amount of consecutive losers in a row, or a matter of overall profit after X months. However you define your exit point, ensure that it’s solid and definitive and stick to it.

And our powerful backtester ensures that the viability of your ideas is assessed quickly and comprehensively, empowering you with the information that you need to trade profitably. An asset or portfolio with a ratio below 1 represents a poor investment, while anything above 2 suggests a great investment. First created in 1966, the Sharpe ratio is one of the most popular risk/return measures used in trading, providing investors with a better understanding of the return of an investment compared to its risk. In fact, it’s probably the most famous risk-adjusted measure out there. The “job” of exit rules is to protect your capital so if a sell signal does not minimize the losses of your trading system then it should be discarded. Many traders can overlook the importance of well-timed and well-executed exits.

Notas del día:

Jul 16, 2025 / 02:00

Trampas en cajeros automáticos de CDMX; quitan una en la Roma

Jul 16, 2025 / 01:13

El reconocimiento presidencial al Gobierno de Veracruz

Jul 16, 2025 / 01:00

Tener pandas en CDMX cuesta 1 mdd anuales; China ahora los renta

Jul 15, 2025 / 22:35

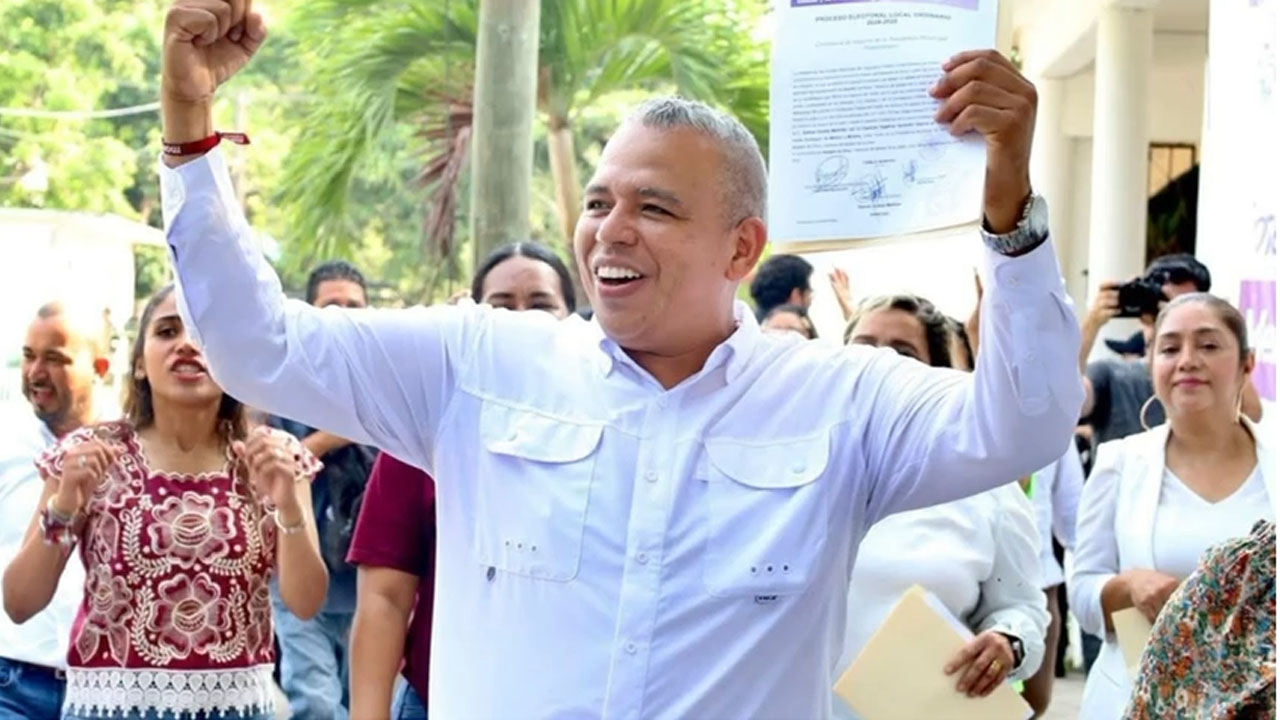

OPLE Veracruz resuelve Procedimientos de Remoción

Jul 15, 2025 / 22:22

Aprueba Consejo de Desarrollo Municipal avance de la obra pública

Jul 15, 2025 / 22:13

Pide gremio 9 de Septiembre y Cañeros Produciendo por México rescate del sector

Jul 15, 2025 / 22:08

Jul 15, 2025 / 22:06

Pide AMPI a inversionistas poner más atención en el Centro Histórico de Veracruz 📹

Jul 15, 2025 / 21:30

Avala Cabildo de Xalapa informe de obra pública

Jul 15, 2025 / 21:07

Gobierno de Alfa Citlalli Álvarez rescata espacios deportivos

Jul 15, 2025 / 21:00

Asiste Beto Cobos a evento en el CAM 17; "los alumnos nos inspiran día a día"

Jul 15, 2025 / 20:08

Se atenderán los tramos carreteros mas críticos de la cuenca, adelanta diputado Felipe Pineda